LONG DURATION ENERGY STORAGE: ELECTROCHEMISTRY TO THE RESCUE

28 March 2023

As the world contemplates ways to limit the rise of global temperatures by reducing greenhouse gas emissions (GHG), the power generation sector remains a leading player in the achievement of this goal.

As the world contemplates ways to limit the rise of global temperatures by reducing greenhouse gas emissions (GHG), the power generation sector remains a leading player in the achievement of this goal.

Europe has made significant strides in reducing emissions from electricity generation, achieving almost 40% reduction since 1990; yet, it still remains a significant contributor to CO2 emissions, accounting for almost 20% of the total. On the global stage, however, the power generation industry has increased its contribution to emissions by a staggering 87% since 1990, making it the biggest single source of CO2 emissions, responsible for 41% of global emissions.

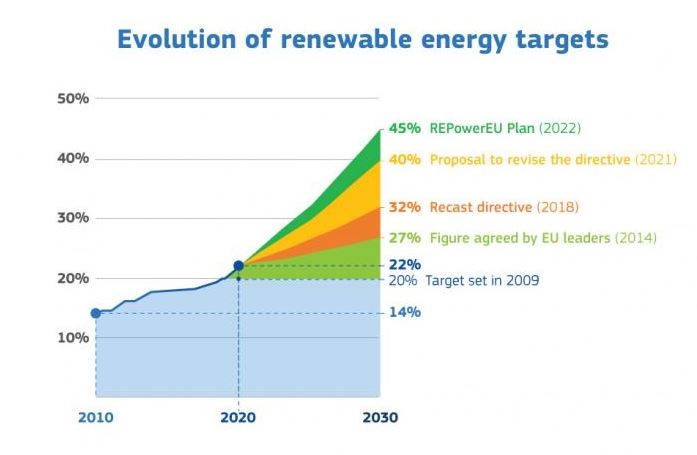

EU’s objective to clean variable renewable energy sources (VRE) as part of the energy transition has been subject to considerations over the past decade. The latest development was the Russian invasion of Ukraine, which led the member states to increase their target from 40% to 45% as part of the REPowerEU Plan.

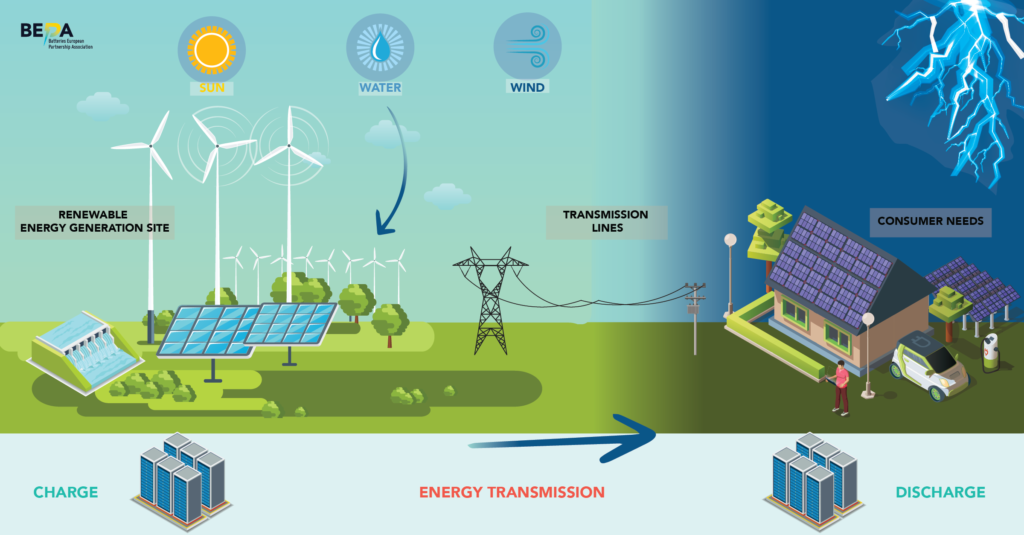

In 2020, 22% of the total EU electricity came from VREs. However, further rise in this value is a multi-faceted challenge. As pricing, regulatory structure and infrastructure of the conventional grid should all be subjected to widespread update, the variability and intermittency of solar and wind energy requires a reliable source of storage that ensures the stability and reliability of generation. Curtailment, the practice of reducing renewable energy generation due to oversupply or grid constraints, remains unexploited in many countries. But, as more renewable energy sources are added to the grid, curtailment rates will likely increase. For example, Germany’s renewable energy curtailment rate was only 2.4% in 2020, and rose to 4% in 2022. The International Renewable Energy Agency (IRENA) estimates that curtailment could range from 2% to 12% of total renewable energy generation in countries with high shares of variable renewables. With such figures, spread of installations of solar and wind will not make up for its generation waste, making VREs lose their cost leverage and investment return of the projects will start to trend downward.

Calculating the right amount of storage needed is complex and dependent on several factors, such as location of demand, turbines and panels, type of service, transmission infrastructure and market design. European Association of Storage of Energy (EASE) estimates that by 2030, Europe needs 200 GW of energy storage to be able to achieve the goals set by REPowerEU. Going there from current installed capacity of 60 GW implies almost 20% of Compound Annual Growth Rate (CAGR), while at the moment the industry is growing by 1%. This is a huge gap to be covered. Based on the analysis by Albertus et al., adaption of 45% of solar and wind requires storage systems that are capable of continuous discharge for 1 to 5 hours, and reaching to 100% in 2050 demands storage at the timescale of seasons. While the exact numbers are dependent on the specific markets, the study draws a semi-quantitative picture of how sharply required storage durations increase with growth in share of renewables.

ELECTROCHEMICAL SOLUTION

Assessing the feasibility of grid storage projects is no easy feat. Their large scale and complex service require a meticulous examination of several parameters beyond mere cost analysis. A thorough technical appraisal of the system’s capabilities is required to ensure its fitness for specific tasks while meeting all necessary regulatory requirements. Additionally, several ESG measures such as community acceptance, permitting and licensing requirements, and local environmental impacts must be thoroughly addressed. The progress timeline of the Moss Landing Energy Storage project is a good example of the hiccups that potentially risk the storage projects. Consequently, dismissing the future of energy storage as a one-size-fits-all solution is a unwary move. The dynamic nature of renewable-intensive power generation demands a diverse range of mechanical, chemical, thermal, and electrochemical solutions to be employed based on specific circumstances.

As for electrochemical energy storage systems (ESS) for instance, one of the main advantages (especially lithium-ion batteries), is that they have a very fast response. This feature makes them the favourite for Transmission System Operators (TSO) from the operational point of view. Also compared to other mechanical or thermal systems, the required land footprint is considerably lower. Despite such merits, cost will be the main factor that determines further deployment of batteries for grid storage.

Globally, electrochemical storage for short durations (<6 hours) has been growing mostly by using lithium-ion batteries. Recently one of the biggest European battery storage projects with the capacity of 25MW/100MWh has initiated the operation in Belgium using LIBs.

The break-even cost for under 6 hours of storage allows for profitability of LIBs employed in several markets. On the other hand, even LIB’s cost and performance properties like 100 $/kWh of capital cost, >90% round trip efficiency and >10 years of lifetime do not make them bankable projects for a series of short-term markets and definitely longer (>8hr) duration storage. Based on a study, despite almost three-fold drop in levelized cost of storage for LIBs in the past decade, the gap with the cost of wind and solar energy is still considerable. Another study shows that for a battery with performance characteristics of lithium-ion battery, the break-even cost for over 8 hours of storage exceeds the cost only for the purchase of its active material.

But what is exactly the cost target for batteries in storage application? Half of the answer depends on the payment that storage services receive.

As mentioned before, payment structures for grid services can be complex and vary depending on a range of factors, including regional regulations, market dynamics, and specific agreements between storage companies and grid operators. In general, short-term services such as voltage stabilization may be paid at a higher rate than long-term services like arbitrage. This is because short-term services often require more immediate and responsive actions, and may be more valuable to the grid in certain situations, such as during periods of high demand or sudden fluctuations in supply. In contrast, long-term services like arbitrage may be less time-sensitive and may provide more stable revenue streams over a longer period of time.

The other half of the puzzle is that for battery storage to be economically viable, the cost per unit of energy expended by storage companies must not surpass the compensation received from grid operators. Considering the cheap electricity of both renewable and non-renewable generation and the resulting competitive advantage, storage systems must be cost-effective both in terms of capital and operational expenditure.

Within the battery research community, there are two common approaches that are used to solve that concern: the first one is to develop chemistries with very low material cost and established supply chain that, despite the hurdles in scaled manufacturing, once deployed at large capacities, promise a competitive floor cost. The other is to de-couple properties of the storage system in terms of power and energy.

The latter is mostly targeted by employing redox-flow batteries. In these systems the scaling for energy content is independent from its power capability. Since the former is measured by the amount of redox species, usually stored in scalable tanks. And the cost and magnitude of the latter is tuned by the electrolyte flow rate, size and design of the reaction stack. The most popular chemistry for this system configuration is vanadium Oxides.

Vanadium Redox Flow Batteries (VRFB) have been first introduced in 1980s and since then several aspects of system has been significantly improved, both chemically and mechanically, among them issues with redox particles’ crossing over membrane (and the resulting lower efficiency) and capacity fading. However, the main hurdle for this technology remains to be its main component, vanadium. The price of vanadium is volatile, and it is almost entirely sourced from outside Europe. Considering the significant required growth in sourcing of VRFBs to be the dominant ESS of the future, this technology will be in margins if they don’t have a seat in future energy materials discussions. Flow batteries Europe has taken the role of representing European community of flow battery stakeholders both in industry and academia. It has recently estimated that Europe will need almost 20GW/200 GWh of this technology to meet its net-zero goals.

Another class of flow batteries are the family of organic redox materials. Here the motive is the very low floor cost associated these materials, that will be the majority of cost share, if the technology is employed at vast scale and daily storage.

Sodium-ion batteries also have gained a great momentum in the last couple of years. An alternative to the lithium-ion chemistry that use the same manufacturing process, but comes with a considerably lower material price, because of abundance and low process cost of sodium and other elements composing its electrodes. This is particularly attractive in Europe, as sodium can be found easily and would reduce the need for imported materials. A new wave of commercialisation of these systems has been initiated by Chinese companies, in particular announcements by CATL for mass production of sodium-ion cells in 2023 and HiNa Battery’s products being used by OEMs. The average 40% lower energy density of these systems is not a crucial issue for stationary applications (at least for front-of-the-meter), yet efforts are underway of rapid improvement to alleviate the problems with low energy density. Faradion and ALTRIS are the main European Companies developing Na-ion systems. The former with the goal of employing the technology in mobility sector, while the latter’s Prussian blue chemistry, that has lower power density compared to layered structure cathode of Faradion, is currently seen to be better suited for stationary storage.

Another viable group of chemistry candidates are metal-air batteries. The heightened interest in such systems has arisen following the success of Form Energy, a producer of Iron-air battery, to raise a new series of funding from several investors, among them early investors in Tesla. Because of using air as the negative electrode, a cheap metal on the negative side can secure the cost leverage of chemistry, but the design and manufacturing of such systems are still challenging. A right trade-off between low marginal cost of a high duration/ large capacity project and low cycling efficiency, can make the economic case of these systems.

EUROPEAN UNION

Just recently, the European Commission published a set of extended recommendations to the member states on energy storage, demonstrating the EU’s awareness on the central role that storage will play in a de-carbonized grid. Here are some of the key recommendations:

1. Develop comprehensive energy storage strategies at national and regional levels that are tailored to local energy needs and resources.

2. Eliminate regulatory barriers that hinder the deployment of energy storage technologies, and create an investment-friendly environment that encourages the development of new projects.

3. Support research and innovation in energy storage technologies to lower costs, improve performance, and increase the sustainability of energy storage systems.

4. Promote the integration of energy storage technologies into the wider energy system through initiatives such as smart grids and demand response programs.

5. Increase public awareness of the benefits of energy storage, including enhanced energy security, lower carbon emissions, and reduced energy costs for consumers.

Following up on the EU response to the Russian invasion of Ukraine, these recommendations add on to the EU’s efforts to significantly increase its preparedness for winter – with new rules on winter gas storage and the encouragement for seasonal and long duration storage especially for the winter months. As highlighted in the paper on the Electricity Market Design Revision by EASE, there are several steps that both member states and the EU can take to ensure the timely uptake of long duration storage considering the generally low TRL level of such technology.

To take advantage of such policies, long duration storage technologies must continue to develop to become not only a reliable an efficient solution, but also a cost-effective one. Just the European Commission recommendations encourage member states to support R&I on this technology, Europe’s battery industry must do the same, both independently and with the support of the EU, from which BEPA can play a key role.

ROLE OF BEPA

Ensuring the sustainable application of batteries in the future of renewable-based generation is set in the BATT4EU agenda. Accordingly, the working group of stationary application is the main reference for the corresponding activities. Engaged with the advanced materials, raw materials and emerging technology working group experts, BEPA’s integrated working groups have a decisive role in informing European policy makers about the strategic importance and demands to unlock the research and innovation needs for electrochemical grid storage.

As for the 2024 Horizon Europe topic on long duration storage, the call aims to develop non-Li batteries that are sustainable and safe, with energy density and power metrics suitable for stationary energy storage applications. Projects must aim to achieve credible projected storage costs of less than €0.05/kWh/cycle by 2030, with a projected cycling life of 5,000 cycles under typical operating conditions. The battery system should work safely and efficiently in a wide range of ambient conditions and have a defined concept for sustainable, circular manufacturing with recognized economic, environmental, social, and ethical metrics.

The proposed projects will contribute to the development of a stronger, more resilient, competitive, and green European economic base by reducing strategic dependencies for critical raw materials. They will demonstrate a clear route to a feasible, European-based supply chain that reduces reliance on critical raw materials and substitutes them with abundant, non-toxic, and inherently safe raw materials. The stationary storage applications may range from small-scale domestic behind-the-meter units to large utility-scale front-of-meter installations.